Our Services

Our staff of experienced benefits professionals can develop benefits programs that make sense for your company and your employees. We have specialists in all lines of employee benefits, with the experience and know-how to keep your programs running smoothly and your employees happy.

The Enterprise Team specializes in a wide variety of plans and lines of coverage, including:

- Insured and self-funded health plans

- Group life insurance

- AD&D

- Dental plans

- Vision plans

- 401(k), 403(b), pension and profit-sharing

- Cafeteria plans

- Voluntary benefits

- Short- and long-term disability plans

Benefit Advisory

From plan design consultation to renewal, we offer the full spectrum of advisory services to optimize your insurance offerings. And our independent status frees us to recommend the very best products, regardless of their orientation.

Benefit Administration

With TET, you can outsource all aspects of your organization’s health and welfare administration, including COBRA, Flexible Spending Accounts (FSAs), Health Reimbursement Arrangements (HRAs), and Health Savings Accounts (HAS).

Communication

We offer trusted and timely information for employers and employees on critical issues. From online resources and on-site meetings to webinars and regular updates, we can tailor a communications program to meet your unique needs.

Compliance

We know keeping up with changing laws and regulations can be time consuming and confusing. Since failure to comply can be costly; our experienced team offers regular updates and guidance on the latest rules that impact you and your employees

Actuarial Analysis

When needed, we employ the services of professional actuaries to assist with calculations critical to your employee benefits plans. We go beyond standard solutions and deliver the maximum value for your benefit dollar. Using employee claim data from your carrier or TPA, we can analyze your data and show how and where to adjust your plan design to save money. We can even model recommended changes to show you the potential savings.

HR Consulting

As your partner, we will provide you an HR Library as an online source for must-have HR tools, forms, and guidance. We also provide a consulting hotline to help you answer questions about employment and HR issues, such as compensation, wages and hours, hiring, dismissal, personnel policy, and more.

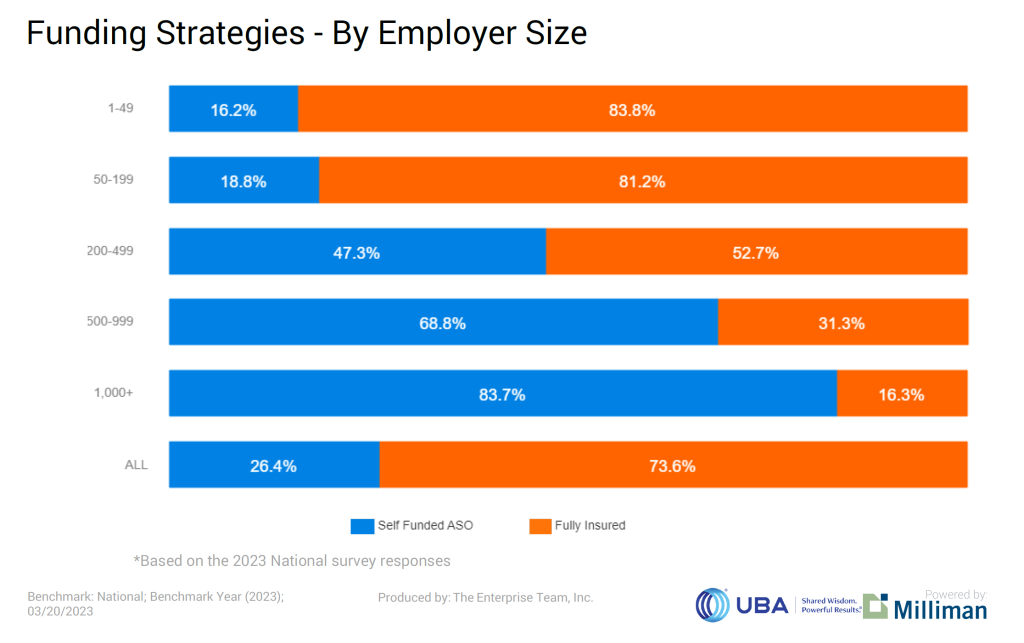

Self Funding

As the cost of health insurance continues to climb, employers are looking for alternatives:

- Self-funding offers employers a powerful, practical alternative to traditional insurance that allows them to reap the benefits of larger employers.

- Self-funding rewards employers for good claims experience in a way that makes sense for smaller businesses.

- Self-funding with stop-loss coverage protects employers from unusually high claims experience.

Flexible Benefit Options

Employers have a wide variety of plan options to choose from:

- PPO Plans

- EPO (HMO like) Plans

- High Deductible Health Plans with an HRA or HSA

- Dual Plan Options

Employers can mix-and-match the benefit variables to meet their specific benefit plan objectives:

- Deductible Amount

- Co-insurance Percentage

- Out-of-Pocket Maximum

- Office Visit Co-payments

- Prescription Drug benefits

Benefits to Members

Lower healthcare costs:

- Discounted (10%) plan management fees

- Flexible plan design to avoid or limit state mandated benefits

- Reduction in taxes – no state premium tax (2-3%)

Other Benefits to Members:

- Excellent reporting capabilities

- Improved cash flow – no carrier claim reserve (IBNR) required

- More control in claims administration

- Consistent benefit plan communications

- ERISA plan vs. state insurance departments

- Improved service – eliminates bureaucracy